Refinance & Consolidation

Have you reviewed your home loan recently?

The official cash rate in Australia is the lowest it has ever been. But what does this mean for you?

Now is the time to review your loan to see whether it is still right for you. Home loans are no longer a set and forget product. We recommend they are reviewed annually – or every two years at a minimum. Much like a dental check-up – prevention is better than cure. Review regularly, use the product correctly and stay financially healthy.

While rate is important, how you use your loan and the way it is structured is vital – and will save you in the long run.

With access to over 50 banks and hundreds of different loan products we work with you to find the loan that suits your individual circumstances.

Is refinancing your home loan the best decision for you?

Refinancing a home loan is suitable for people who are seeking better rates in the long run. You can opt to make changes to your loan by switching between a fixed or variable rate. You might also look to refinance by consolidating some other debts (like credit cards, car loans and personal loans) into your home loan.

Keep in mind, refinancing may not always be the best decision for you. Depending on your situation, and your intention, there may be other financial instruments or methods that can be of greater benefit.

Step 1: Determine capacity for refinancing

The first step is to evaluate your capacity to refinance your existing home loan and consolidate your other debt.

Step 2: Get your property revalued

As soon as your property is revalued, you will have a clear indication as to what amount of equity you can tap into (if any).

By chatting to a Time Home Loans broker about your future plans, we can help you assess whether the equity you have can help make these plans a reality. We can also help you assess if refinancing is the best move forward for you.

Step 3: What’s currently on offer?

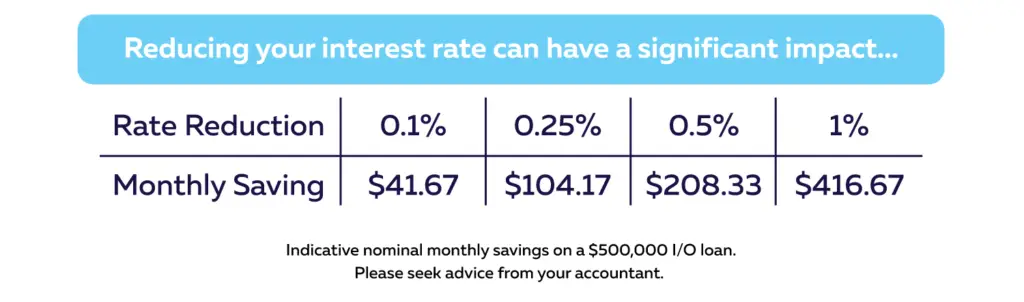

If you decide that refinancing your home loan is the best move forward, we will investigate the details of your current loan. We’ll look into what rates your current lender has on offer in the market and compare to the rates you are paying.

If you can get a better deal with your current lender, this is always an advantage as you do not have to worry about changing accounts or going through a new application process. If your current lender or bank doesn’t seem to have a better option for you, you have every right to shop around and find another lender who can meet your current needs.

That’s where the Time Home Loans team shines. We love ensuring that our clients have access to the best opportunities for their situation. We’ll take care of re-negotiating with your current lender. If we think you can get a better deal elsewhere, we’ll look around on your behalf while you focus on the things that are important to you.

Our aim is to ensure that each and every one of your repayments goes further and is a better repayment in future. With over 30 lenders at our fingertips, we have plenty of options to help make this a reality.

Step 4: Ongoing client care – The Time Home Loans difference

At every step of the way, we will communicate with you and let you know what we have found. Our ultimate aim is to ensure you end up in a better position than when you started. The decision to move to another lender or to refinance with your current lender is a big one.

That’s why, with Time Home Loans, the process won’t just stop once you make the decision to refinance your loan or not. We can offer you ongoing care by re-evaluating your loan status on a yearly basis. We’ll make sure the offer you’ve received is still competitive on the market or at least competitive with what the bank is offering to the market at that given time.

We’re here to help you every step of the way. We take pride in our ability to care and keep a personalised connection with you throughout this process and, we’ll make sure you’re paying as little as possible while securing you a better outcome.

But where to start? We can help you weigh it all up.

Research and having the right people to help you are the keys when refinancing your property.

As time marches on, situations change. Perhaps you’ve changed jobs? Or there’s a new addition to the family? Maybe you would just like a better rate? Maybe it’s the advent of school fees, or perhaps the kids have flown the coop? Or maybe that leaking shower or tired kitchen has just reached the end of its life.

A shift in circumstances may mean it is time to revisit your home finances. For many, the idea of refinancing a mortgage can be daunting. Fees, fixed versus variable interest rates and monthly charges all need to be considered.

The right refinanced loan could help you pay off your mortgage faster and for less, clear unhealthy debt or help you upgrade and add value your home, all of which are steps in the right direction.