Buy or sell first? Let’s bridge the gap.

Bridging Loans – what are they?

You’ve found your dream home, but you haven’t sold your existing one yet. You want to secure it before you sell your existing home so that you don’t find yourself with no-where to live. Let us help you bridge the gap.

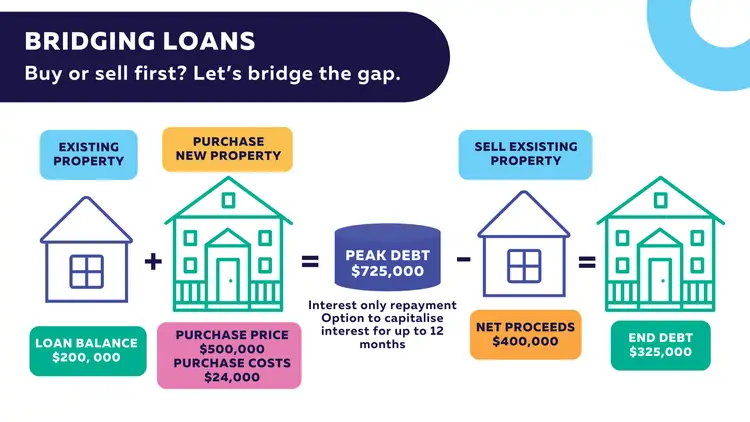

A bridging loan is a short-term facility that covers the financial gap between the purchase of your new property and the sale of your existing property.

Eligibility

A bridging loan is available to clients who have the necessary equity in their property to be able to secure the funds required to bridge the gap between your current property and the new purchase.

A quick calculation to determine whether you may be able to secure a bridging loan is:

- The current balance of existing lending; divided by

- The estimated value of your existing property; multiplied by 100

- Will give you your current Loan to Value Ratio ( LVR – your total loan amount shown as a percentage of the value of your property).

If you current LVR is over 70%, then bridging probably is not a viable option for you, but there may be other ways to secure your property. If your LVR is below 70% you may be eligible for a bridging loan. The lower your LVR the more viable a bridging option becomes.

Benefits

A bridging loan gives you the flexibility to purchase a new property before you’ve sold your existing property. In a competitive market this could be the difference between purchasing the ideal property or missing out due to timing.

It can take the stress out of having to align your property settlement dates, to give you more control.

It allows you to borrow more money than you otherwise could under normal circumstances. This is because lenders understand that your total overall home loan debt will be reduced once you have sold your current property and paid off the bridging loan amount.

Benefits

Interest is calculated daily and charged monthly, which means the longer it takes you to sell your current property, the more interest you will pay.

You may end up selling your home for less than you expected, which may leave you with a higher home loan balance than planned.

If you can’t sell your current property within the 12 month timeframe from the day your bridging loan is funded, lenders may consider this a default and step in to assist with the sale of the property.

In the event of a default, you can lose your property and you may still owe money.

Timeframe

Other considerations

Common Questions

What happens if I need the bridging loan for more than 12 months?

12 months is generally the longest lenders will provide a bridging loan. You should only consider taking out a bridging loan if you’re confident you can sell your current home within this timeframe.

If you take out a bridging loan and then realise you can’t settle the sale of your homein12months (or if you would like to explore options to keep your current home), contact us to discuss the relevant options available to you.

What if my current property doesn’t sell for as much as I expected?

Under the bridging conditions, you will still be required to repay the outstanding balance remaining on your bridging loan. Bridging loans have failsafes built in to allow for you to sell your property less than the valuation completed. We will let you know the minimum you need to be able to cover your bridging loan. Should your proposed sale price be less than this, reach out to us to discuss your options.

What if my current property sells for more than the property I am purchasing, do I still need an ongoing home loan?

Not all lenders offer bridging loan facilities, and of those that do, only one allows you to borrow for bridging with no end debt.

However, if you do secure more that will allow you to payout your end debt, we can certainly assist with helping you pay out the loan facility shortly after settlement.