Lenders mortgage insurance (LMI)

LMI is an insurance policy that covers the lender against any losses they may incur if the borrower defaults on the loan. LMI does NOT cover the borrower – it only covers banks and lenders. LMI is dead money for all borrowers.

There are two main LMI providers in Australia: Genworth Financial and QBE.

How much does LMI cost?

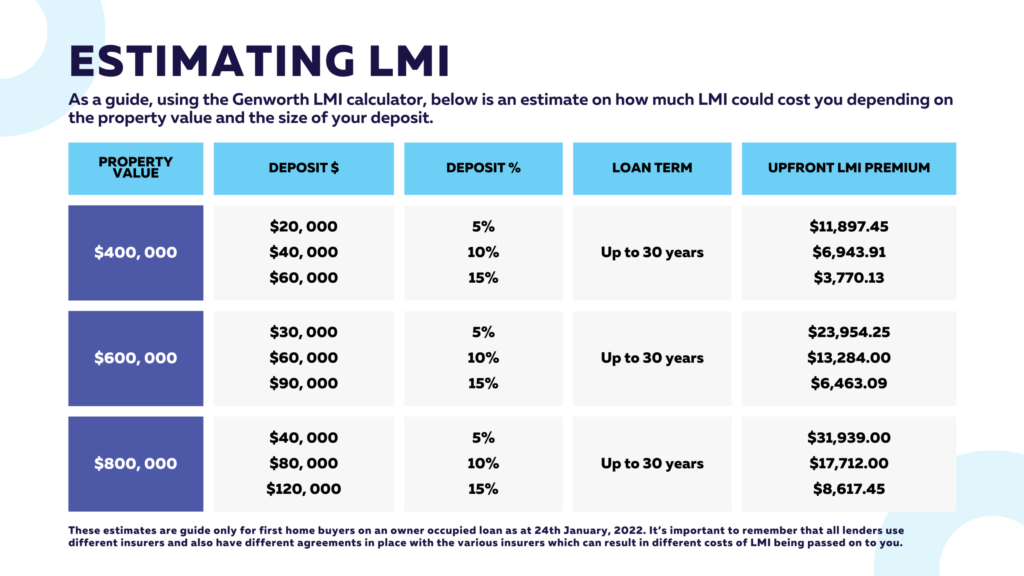

Depending on your LVR, LMI can be a big expense and can cost anywhere from a few thousand dollars up to tens of thousands of dollars.

The cost of LMI can vary based on a few factors including:

If you’re a first-home buyer

Which state your property is in

If you’re an owner occupier or investor

The size of the loan

Your loan-to-value-ratio (LVR)

Your job/industry

Your chosen lender

How to avoid LMI

The most common way to avoid LMI is to have your 20% deposit in place. It’s also important to take into account the fact that not only will you need your 20% deposit, but savings to cover associated costs with your purchase, such as stamp duty, titles office fees, legal costs and other sundries.

There are a couple of ways to avoid LMI altogether, and if you can, why wouldn’t you?

Use your profession to your advantage. Some lenders have what they call Professional LMI waivers. Those employed in the medical, accounting, finance or legal fields who are degree qualified may be able to avoid paying LMI within certain parameters.

Government Schemes and Grants. With Government Grants like the First Home Loan Deposit Scheme (FHLDS), first home buyers are able to purchase a property with a deposit as little as 5%. The Government acts as a guarantor, so the borrowers don’t have to pay the LMI.

Have a guarantor. If you have a parent who has lots of equity in either their home or investment property, then you may be able to have a guarantor loan to get around paying LMI. This option also can allow you to borrow 100% of the purchase price plus also lend you a little bit more to cover the costs of the purchase, like stamp duty, titles office fees, legals etc.

Apply with certain lenders. Some lenders offer discounts or even waive LMI fees for some borrowers. Lenders like Citibank, ME Bank and even St George have had either reduced LMI fees or waiving LMI for loans with an LVR of up to 85%. Lenders put out special offers from time to time so it’s always a good idea to check in and see what’s on offer as it could save you thousands.