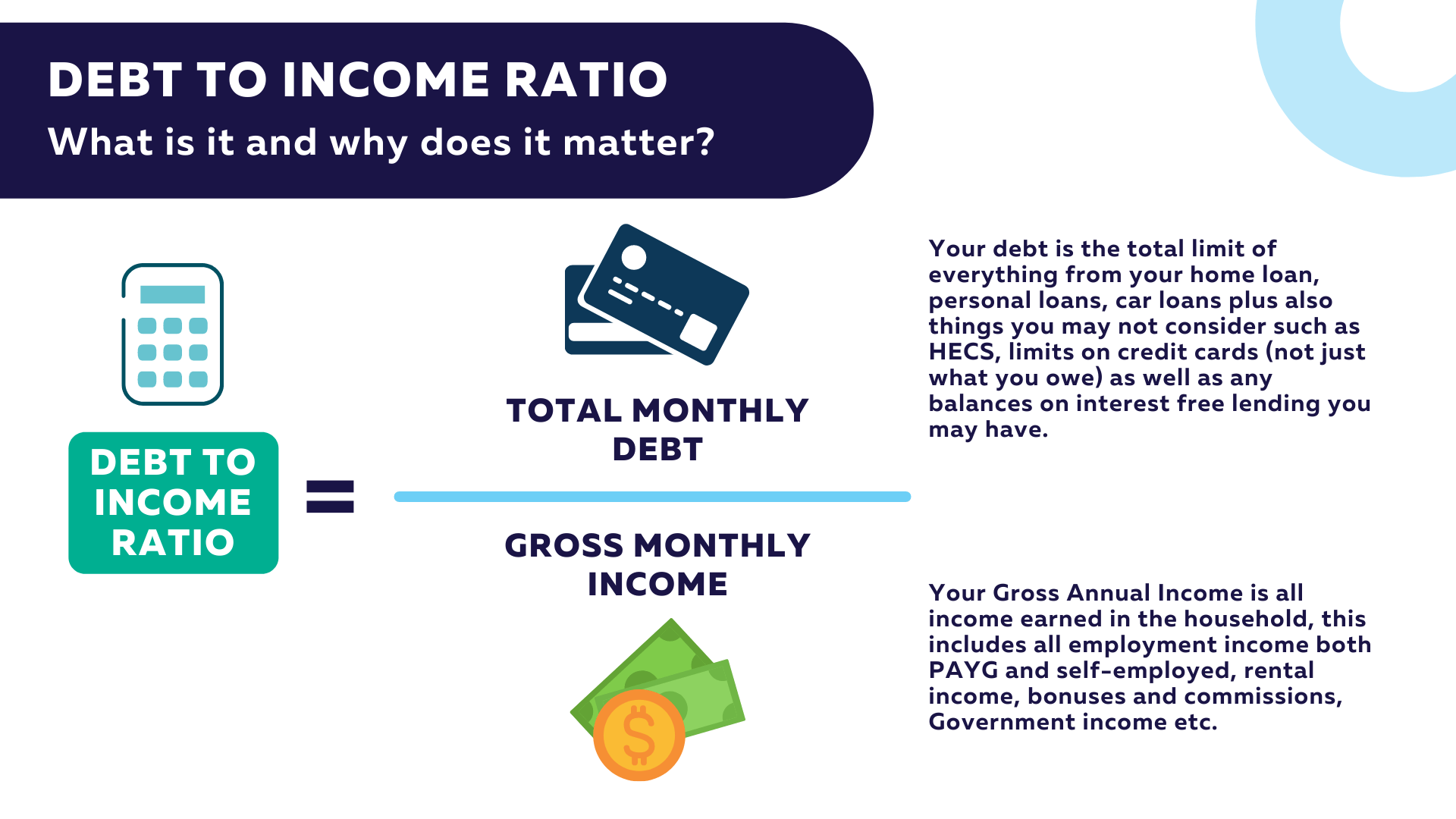

Debt to Income Ratio (DTI) is simply your total debt level divided by your total gross annual income.

Your debt is the total limit of everything from your home loan, personal loans, car loans plus also things you may not consider such as HECS, limits on credit cards (not just what you owe) as well as any balances on interest free lending you may have.

Your Gross Annual Income is all income earned in the household, this includes all employment income both PAYG and self-employed, rental income, bonuses and commissions, Government income etc.

If you earn $80,000 per year and have a credit card of $6,000 and a home loan of $400,000 (D) then your DTI is 2.2, meaning you owe 5.075 times what you earn.

DTI is a tool that lenders use to ensure that they are following responsible lending by ensuring that they are not letting clients get themselves in too much debt. By limiting the DTI of lending, they can ensure that you don’t exceed more than 40% of your total income on loan repayments. This should then ensure that you aren’t over exposing yourself and means that you should be able to comfortably afford your loan repayments and therefore any kind of financial hardship.

Does DTI affect how much I can borrow?

Yes. Many Australian lenders use DTI to limit how much they will lend to clients. For instances, most will no longer lend if your DTI is 7 or over and even over 6 they will impose certain restrictions, like reducing your Loan to Value Ratio (LVR). Regardless if you can afford the loan on paper, if your DTI is too high, lenders won’t approve your application.

Are banks flexible on DTI limits?

Lenders are becoming even more black and white and therefore they hold firm to their limits. Mitigating factors asking lenders to go over their DTI limits have to be pretty compelling and it would be rare for them to do so.

As at December 2021, APRA stated a debt to income ratio over 6 is risky lending. Over the last few years many clients have taken advantage of low interest rates which has seen a rise in people taking out larger and larger loans. A report released by APRA in September 2021 stated that over a quarter of Australians had a DTI higher than 6.

Do all lenders use DTI assessment?

Pretty much. Some lenders apply hard and fast rules, while others will allow you a little bit of leeway. Speaking with one of our brokers will take the hard work out of finding a loan that is going to suit you. We know how to navigate the murky waters of fitting income policy to security policy to DTI limits with lenders, all of which are looking at together to determine your ability to borrow.